Every precaution taken against disaster by U.S. investors in 2016 was on display in the stock market this week.

Short sales that earlier reached the highest level since the financial crisis were covered, while bearish options bets were closed. Meanwhile defensive industries such as consumer staples and utilities powered the S&P 500 Index to its best week in seven months. When it was over, the two-day trauma that followed U.K. voters decision to secede from the European Union was all but erased.

The S&P 500 surged 3.2 percent to 2,102.95, including three consecutive daily gains of more than one percent, something thats happened only two other times since October 2011. At Fridays close, the index was less than half a percent from its level before the U.K. referendum.

There was a two-day period where people were freaking out, but at the end of the day, people did hedge going in, Pravit Chintawongvanich, head derivatives strategist at Macro Risk Advisors, said by phone. The fact that people were aware that this could happen, that limited the severity of the initial sell off.

Evidence that short covering helped fuel the subsequent advance was visible in the performance of a Goldman Sachs Group Inc. basket of shares with the most bearish bets. The index surged 5.2 percent on the rallys second day, the most since 2009. Traders said a decline in the CBOE Volatility Index on Monday, when the market fell almost 2 percent, signaled investors cashed in on Brexit hedges. VIX futures volume had surged 40 percent in the days leading up to the vote.

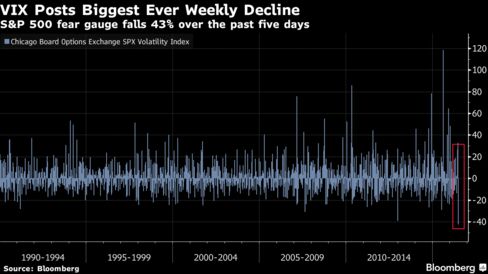

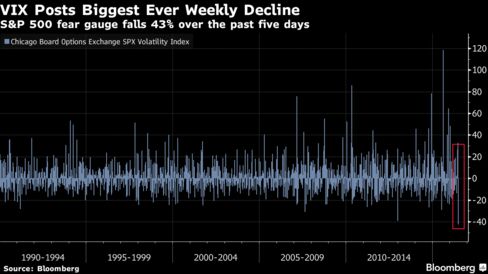

The precautions led to a wild ride on the VIX. After the option-derived measure of stress surged 49 percent the day after the referendum, it posted the biggest weekly decline in history. The VIX and the S&P 500, which move in opposite directions 80 percent of the time, on Monday fell together by the biggest degree since August.

The move out of Brexit, people were a little bit more prepared for than they were last fall when Chinas devaluation rocked the market, Russell Rhoads, director of education for CBOEs options institution, said on Monday. You do have people with positions in place that theyre ready to take off. With people taking off the long put options, its pushing down implied volatility and resulting in a lower VIX.

Automated funds emerged as big winners. CTAs headed into the referendum with bearish bets on U.S. equities, allowing them to make money amid the turbulence, Nikolaos Panigirtzoglou, global market strategist in the multi-asset allocation team of JPMorgan Chase & Co., wrote in a note Friday. The funds quickly reversed to a long position, adding to their gains and in turn fueling the equity rally, Panigirtzoglou said.

While every industry in the S&P 500 rose over the five days, gains were dominated by industries least-tied to economic growth: health-care, utilities and phone companies rallied at least 4 percent. At price-earnings ratios of 23 for staples and 19.7 for utilities, both groups are more expensive than the benchmark and at least 20 percent above their five-year averages.

The buoyancy from U.S. stocks helped investors avoid the fate of past corrections induced by overseas concerns. While some analysts predicted a repeat of the August rout, central banks commitment to help markets navigate the turbulence lifted equities. The vote led traders to push back the expected timing for higher interest rates, and better-than-forecast data reinforced optimism that the economy will continue to expand.

The market is basically signaling that while Brexit is important, theres a sense that Europe isnt on the brink of falling apart, Matthew Kaufler, a portfolio manager with Federated Investors Inc. who oversees funds with about $2 billion assets, said by phone. Thats emboldened investors to get back in after the initial drop.

Health-care stocks were among the biggest gainers, with a 4 percent rally that was the best since March 2015. Endo International Plc, the groups worst performer in the two days after Brexit, ended the week 14 percent higher for the biggest gain.

Deal activity added to the rise. Mondelez International Inc.s $23 billion bid for Hershey Co. Thursday lifted the chocolate maker to the best performance among consumer-staple stocks even after it rebuffed the bid. The end of the second quarter on Thursday also spurred investors back into the market, Chintawongvanich said.

People panicked and sold at the lows, thinking it would get worse, but it didnt. The quarter-end came and people said, we cant not get involved, he said. That added to the rally over the last couple days, especially as they thought, well if this is nothing and central banks are going to help us, we cant not participate as we near highs.